Automate Your Trading Decisions: How I Use Expert Advisors as a Discretionary Trader

5 trading robots I use to maximise trading profits, help me pass online prop firm challenges, and ensure I get a great night’s sleep

EAs, or “expert advisors”, for those unfamiliar with MetaTrader, are algorithms that make trading decisions. They are commonly associated with systematic trading strategies, often used to create steady profits through a hands-off approach.

As a purely discretionary trader, I didn’t think they would be helpful in my trading. All my trading decisions are based on careful judgement and I felt trusting an algorithm to do this was too risky.

But in the 24-hour-a-day forex market, I came across countless situations where a simple decision to close a trade or pull an order while I was asleep could have saved me money.

Living in Australia and trading European and US markets also meant I was often asleep during large price movements, so I would often miss breakouts of good levels, which also lost me money.

Being acutely aware of this often led to a terrible night’s sleep, as I’d often check my phone in the middle of the night. This impaired my daytime trading performance, which, yep you guessed it – lost me more money.

If only there was a way I could make trading decisions ahead of time, and then have an EA execute the decision for me while I was asleep…

So I had some EAs built that could solve these problems. Using these EAs has not only helped me maximise my profit potential and avoid unnecessary losses, but they’ve given me what so many forex traders crave – a restful night’s sleep. Knowing that you have an EA running to make trading decisions for you while you sleep allows you to completely detach from the markets, and get that deep restorative sleep you need to be on top form the next day.

Some of these EAs also help me pass online prop firm challenges, by protecting me from the maximum daily drawdown rule, or closing trades for me during scheduled news events.

Here are the five EAs I use to maximise trading opportunities, minimise losses, and ensure I get a great night’s sleep.

1. Frontrun defender

We all know the frustration of getting front-run on an excellent setup. But there’s an even more frustrating situation. Let’s say you leave a resting order overnight to buy a great level. While you’re getting your beauty sleep, the trade works perfectly. Well, not quite. It skims your entry, heads straight to target, then promptly comes back to fill your order, and immediately stops you out.

This has to be one of the worst things to wake up to.

Trader Dante has a rule that if price reverses just shy of his entry, and then moves more than 50% toward his target, he would pull the order. Following this advice has saved me countless losers, but I couldn’t follow this rule while I was asleep. Or could I?

Now whenever I have a resting order I want to leave in overnight, I use my “Frontrun Defender” EA to make sure it will only fill when the trade setup is still valid.

First I decide how close to my entry price has to come to consider the entry front-run, which I usually use as within 1-4 pips from the level.

Then I measure 50% toward the target in pips or ticks and enter this value. After that I go to bed, safe in the knowledge that my order will get pulled if I get front-run, and my future self thanks me.

2. Rounded retests

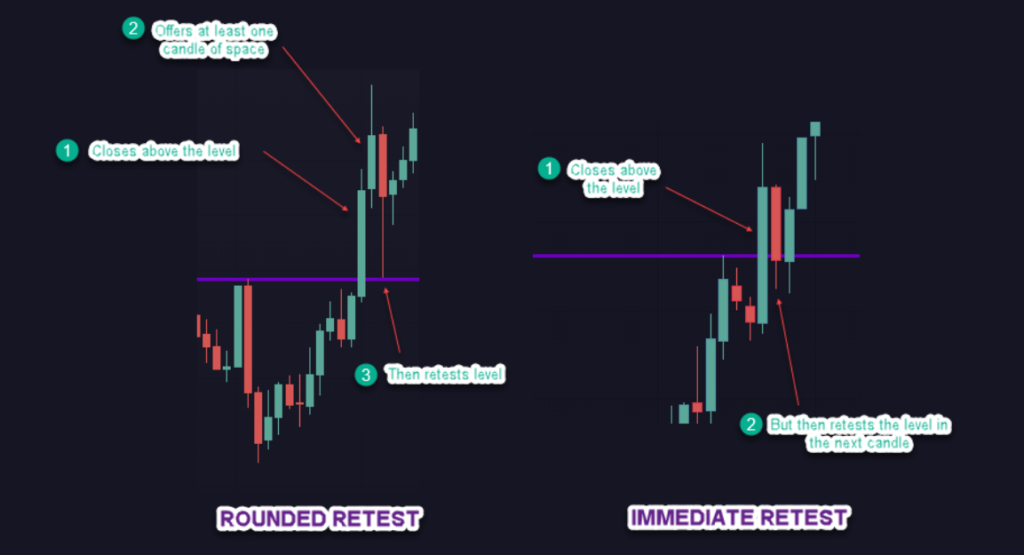

In my trading strategy, I only trade rounded retests. This is where price closes through a level, then makes at least one more candle of space before coming back to test the level from the other side.

These types of entries just seem to be more reliable than immediate retests, which often lead to false breakouts. This makes sense, given price has shown more acceptance through the level, and more participants will become aware that the level has been broken. This leads to more orders at the level, which creates more of a reaction when price hits it.

This was ingrained in me by Trader Dante many years ago. But in order to be a true a rounded retest, the level must also be “naked”. This means that after the break and close through the level, it doesn’t immediately retest the level before creating the space needed for a rounded retest. Again this leads to a more reliable reaction, probably because having the level still “naked” means no one on that timeframe has yet been able to get onboard the break, and so any resting orders would still be there when price comes back to it.

Living in Australia I’d often be staying up until the early hours waiting for that second candle of space after breaking a level, and making sure the level was still naked, so I could finally place the order and go to bed.

Now I use an EA to do this for me. Before I go to bed I put in the price level I want to trade a break and rounded retest of, my stop loss, take profit, and position size. The EA will only place the order if the criteria for a rounded retest have been met, and the level is still “naked”.

3. Timed Trade Closer

We all know how unpleasant it is to have to wake up in the middle of the night and close a trade because of some scheduled news event. Not only does it disrupt your sleep by waking you mid-sleep cycle, but if you’re a light sleeper like me you may find yourself worrying that your alarm won’t go off, and the whole night’s sleep ends up ruined.

Besides news events, there are also those times where you might need to close a trade to avoid gap risk – on the Friday close for forex, or overnight for some futures and indices. And if you’re an FTMO trader you’ll know the rule that if an instrument has more than a 2-hour rollover to the next day then the trade must be closed.

Having to do this was a constant sleep disruptor for me, because it was never as simple as waking up, pressing a few buttons on my phone, and then going back to sleep. Upon closing the trade I’d always see if the trade was in a profit or loss, then the thought train would start up. How did that incredible setup turn into a loser? Did I get stop-hunted? Why could it not reach its target? Or I might see that the trade had hit target, and now with a solid hit of dopamine to my reward pathway, I would be wide awake for the next hour.

Better to just let my neurotic brain sleep while my EA does the work. Before I go to sleep, I place the EA on the chart where the order or trade is and enter the time it should close the trade or pull the order.

Now I can close any open trades and pull any resting orders ahead of big news events, or ahead of the weekend close.

4. Prop firm challenge daily drawdown

Anyone who has taken an FTMO or other prop firm challenge will know about the daily drawdown limit. This is a rule that if you experience a drawdown of greater than 5% on any single trading day, you lose the challenge.

In FTMO, the 5% drawdown calculation is based on the balance at 00:00 server time each day. But in other prop firm challenges, they may also use the equity value at 00:00 server time. Keeping track of the equity is a lot harder, given this will be constantly changing if you have any open positions. It means that whenever you have an open trade, you have to check the equity value at 00:00 server time each day so you know where the 5% loss limit lies, and adjust orders accordingly.

Many traders breach the maximum daily loss limit without being aware of it. This is more common in challenges that use end-of-day equity as well as end-of-day balance in their calculations.

It’s easy to breach this if you’re not careful. So I had an EA built that had the option to account for end-of-day equity in addition to end-of-day balance. Now if I come close to the 5% daily drawdown limit, it closes any open positions I have. It means I no longer have to check my equity and balance at midnight server time every night when I’m in a position. It’s always good to have a fail-safe like this to make sure you stay in the challenge.

5. News events scheduler

I’m not a news trader, so I avoid trading during any major news events. Trading for FTMO also requires me to not have any orders filled in the two minutes before and after news events. So it’s crucial that I pull orders and close positions ahead of these times.

But I struggled with this. Being a forex trader who works on his own schedule most of the time, scheduling events and being aware of significant dates and times (not to mention in different time zones) would always trip me up. Inevitably I’d find myself leaving an order in during a major news event and suffering the consequences. I tried to rely on a system of setting alarms each day, but I struggled to keep up with it.

So I built an EA to solve the problem. It allows me to set up to 20 different news events and select which instruments it will affect. When each news event occurs, it will delete resting orders and/or close any open positions in the affected markets.

It’s now part of my trading process at the start of each week to set all the major news events in the EA. Now if I forget to set an alarm, my EA will make sure to pull orders or close any open trades for me.

A final note on running EAs

A VPS is a cloud-based, virtual server, that allows you to continue running EAs remotely without needing to keep your PC on. It’s the safest way to run EAs as it protects against your PC crashing or experiencing a power cut.

I use LinkUpHost with the Forex44 plan which works well for running the EAs described above over five different MT4 terminals.

I hope you find similar EAs that are helpful in your trading approach, and allow you to live a more balanced lifestyle. We all know how draining trading can be, and the impact this can have on our mental and physical health in the long run. So we should use any tools we can to lessen the negative impacts of our chosen career.

These EAs not only help me sleep, but they allow me to get out and about more during the day. I just set them up before I head out, and then I don’t have to keep checking my phone or worrying about what the market is doing. This allows me more time and mental space for everything else life has to offer.