Enhance Your Edge by knowing the odds

OddsRadar arms forex traders with probabilities, instead of signals, so

you can trade your way, with the odds on your side.

Know the Odds

OddsRadar uses algorithms to collect data on the odds of common price patterns. It uses this data alongside current market context to find higher probability trades.

Weekly Alerts

Price pattern alerts every Monday covering all major forex, indices, commodities, and futures markets. Detailed insights into the odds of price movement that week.

Trade your Way

OddsRadar gives you probabilities, instead of signals, so you’re not just copy trading. You decide if the odds are good enough for you to take the trade.

The OddsRadar Story

I’m a data-driven, price-action based, discretionary trader. I trade my own account and for the online prop firm FTMO.

When I’m not trading, I work as a doctor. When practising medicine I use scientific evidence to guide my decision making. Trading is no different. Only in trading, there’s no access to scientific evidence.

When I started out, this frustrated me. Without the years of market experience, how could I know if my trade would work or not? It was like prescribing a medication with no idea if it would help, or harm, the patient.

So I began building an evidence base. Using algorithms I collected data on price patterns and used these probabilities in my trading each day. This approach helped me become consistently profitable and get funded by FTMO.

Now I’m sharing the same data through OddsRadar. Use these probabilities to take control of your trading, and enhance your edge in the market.

3 Steps to Transform Your Trading

Ditch The

Signals and Copytrading

Become an

OddsRadar Member

Trade with

Probability on Your Side

How It Works

Each Monday before the London open you get a market report highlighting any higher or lower probability price patterns across all major forex, indices, commodities, and futures markets.

OddsRadar selects the best price patterns that week, with the best market context, and gives a detailed breakdown of the odds, using data from the OddsRadar database.

Use these probabilities to enhance your edge however you choose - you decide on your trigger timeframe, entry method, where your stoploss and target will go, and how you will manage the trade

What's Included

Weekly alerts of trade opportunities, sent by email prior to the London Open every Monday.

Covers all major forex, indices, commodities, and futures markets (click “Download PDF” for full list of included instruments).

Detailed assessment of the odds for each trade opportunity.

How to interpret this data and use it in your trading each week.

Weekly and daily levels for each trade opportunity.

Complements any trading strategy or can form the basis of a new strategy.

What's Not Included

Exact setups/entries/stop losses/targets. OddsRadar is not a signals service and is for traders who already know how to trade.

Guaranteed profit from using provided data. OddsRadar will tell you how price patterns performed historically, but past performance doesn’t guarantee future performance.

Advice on risk management. Trade at your own risk and do not use capital you can’t afford to lose.

Alerts with high probability setups every week. Sometimes there won’t be any suitable price patterns in the market on a given week. This is the nature of the market.

How OddsRadar Gets Its Data

OddsRadar uses algorithms that collect data on the odds of daily and weekly price patterns.

Looking at the odds over the long term (10 years +) and shorter term (1-5 years) it looks for trends and assesses how consistent these patterns are over time.

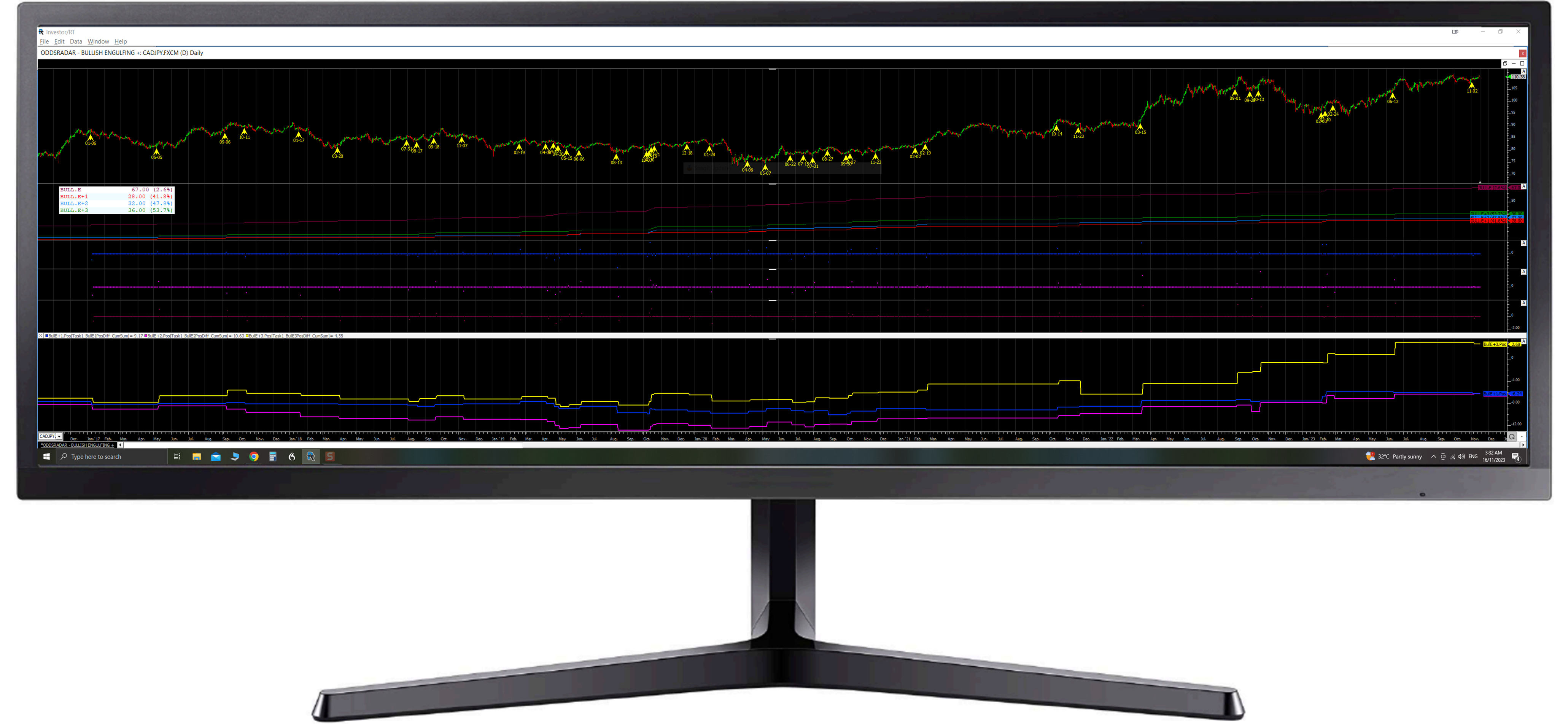

All data is collected using InvestorRT and is quality checked prior to use by OddsRadar.

How OddsRadar Uses This Data

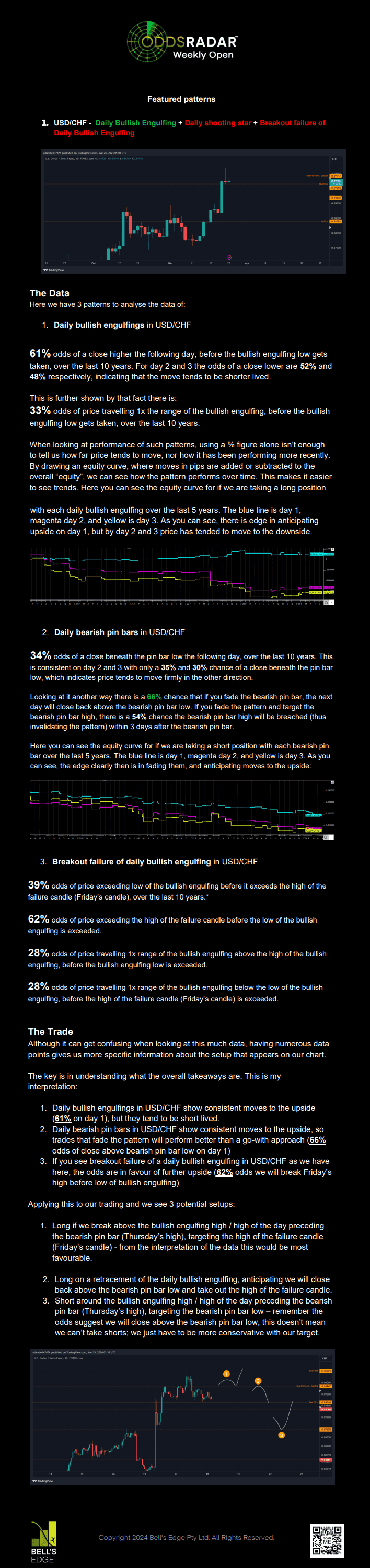

The OddsRadar Weekly Open is a free weekly report. It details any suitable patterns in the market that week. Here’s an example report:

Frequently Asked Questions

Knowing the probability of a given price pattern, in a specific market, can enhance the edge of any strategy. By looking at how the pattern has performed over the last 10 years+, as well as looking at more recent performance, you can have a better idea if the odds are on your side.

OddsRadar is continually updating its database looking for new patterns and improving on the way it collects data on current patterns. It currently includes data on hammers, shooting stars, engulfing bars, inside bars, marobozu bars, and bullish/bearish tail bars. Not only does OddsRadar keep extensive data on trading in the direction of these patterns, but it also looks at trading in the opposite direction should failure of these patterns occur. It also considers the odds for when one pattern is immediately followed by another eg. a hammer is followed by a shooting star.

No guarantee or recommendation is made based on the data provided. Past performance of a price pattern does not guarantee future success of the pattern. How you use the data is entirely up to you. When you sign up for either the free or premium service, please make sure you carefully review our disclaimer.

OddRadars cover the following forex markets: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CHF, USD/CAD, USD/JPY, EUR/JPY, GBP/JPY.

The spot metals XAU/USD and XAG/USD.

And the following futures markets: Light Crude Oil, E-mini S&P500, E-mini Russell 2000 index, DAX, and FTSE 100 Index.

For the stock indices, crude oil, and natural gas, OddsRadar uses the front month futures charts over the cash market charts. This is because the professionals tend to use the futures charts for these instruments, and thus the price patterns from the futures charts tend to be more reliable than the cash charts.

The report is published every Monday at 6am UTC. You’ll get an email link notifying you every time a new report is available. You can also view the report by logging into the members section at www.bellsedgetrading.com

Each OddsRadar Weekly Open report is available for up to 28 days. At any time you can see the last four Weekly Open reports by logging in to the members section of the website.

Please check your spam/junk mail folder. Make sure you mark the email “Not spam” and add [email protected] to your contacts. This helps ensure future emails arrive straight to your inbox. If you still haven’t received anything, please email [email protected].

Simply log in to the “Members” section of www.bellsedgetrading.com, click on “Account” and under "My Memberships" choose “Cancel”.

No. OddsRadar never provides exact trade setups, only data-driven insights and educational content into the probability of price direction. How you use this information is up to you.

Please send an e-mail to [email protected].