How I Passed Two FTMO challenges and Gained an Account Size of $400k

7 tips for success

In December 2022 I passed my second FTMO challenge, giving me a total allocation of $400k, the maximum amount you can start with. Passing them both wasn’t easy. Trading under challenge conditions affects your psychology, with the stakes feeling bigger with each trade you take. The next trade could get you closer to the profit target and a brighter future with higher income potential, or it could get you closer to the drawdown limit and lose you the challenge fee.

After failing my first challenge, I realised I couldn’t just trade the way I normally did on my personal account. I had to tailor my trading to suit the challenge parameters. So I backtested different approaches and discovered ways to massively improve my chances of passing it.

But before you even consider taking the challenge, make sure your trading strategy is profitable over a decent enough sample size. This would ideally be at least 12 months, or at a bare minimum 30 trades. Taking the challenge before knowing your strategy is profitable is a low-probability bet and will likely end up in forfeiting the challenge fee. And even if you do pass it, it’s unlikely to result in a higher income potential as a breakeven strategy with an account size of $400k is still a breakeven strategy. If this is where you’re at, keep working on your edge, and as soon as it’s profitable, go for it.

If you’re profitable already, follow these six tips to maximise your chances of passing the challenge the first time.

1. Find the optimal risk per trade

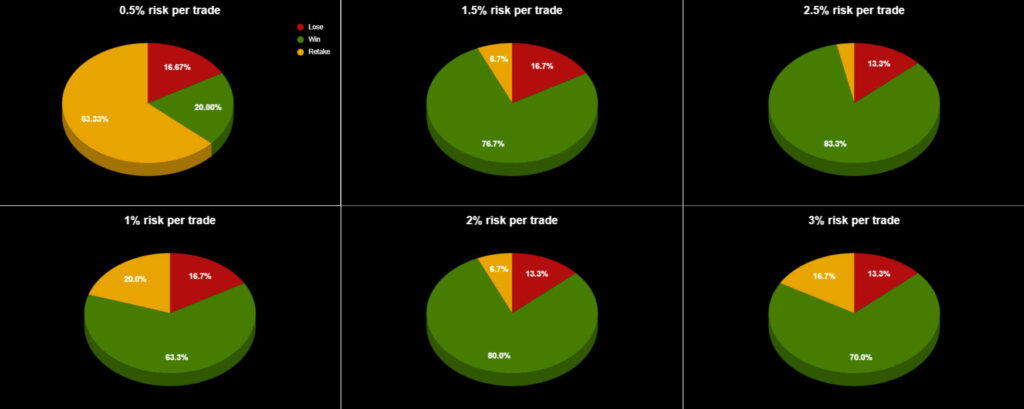

As you can see, the sweet spot was around 2.5%, which was perfect as this meant I could take two losers in a row the same day without breaching the 5% daily drawdown limit (but to allow for slippage I made this 2.4%). It also allowed for four losers in a row before I was out.

You might think this level of risk is too high, and that it would be safer to go in with lower risk to give yourself more opportunity to get into your stride. This could be true if your frequency of setups is higher. But for me, the risk of not reaching 10% by the end of the challenge was greater than the risk of failure at lower risk levels. Run your own stats and see where your risk “sweet spot” is for your strategy.

2. Only start the challenge when a high R trade comes your way

The beauty of the challenge is that it doesn’t start until your first trade fills. So you can buy the challenge and then watch and wait until the trade with the highest return on risk comes your way. Then, and only then, should you pull the trigger.

My aim was to pass the challenge on the first one or two trades alone. At 2.5%, I just needed to make 4R in those first couple of trades. The best way of achieving this was to only start the challenge when a trade with a high reward-to-risk ratio came along.

Also remember that if the trade doesn’t fill, the challenge doesn’t start. So rather than waiting for the perfect high R setup to come your way, you can also just try for a more conservative entry in a lower R trade. If price squeezes, you might get filled at a great price, and get a much higher R.

But be careful with this. Make sure that you’re not getting in at a price point where the odds of the trade working then diminish. Just get in at a point where it would be reasonable for price to squeeze to.

3. Once the challenge starts, take every trade in your strategy

As well as testing risk parameters, I also ran simulations to see if trading only certain setups could improve my chances of passing. For instance, I looked at trading only when there was a clear high timeframe bias, or only taking quick level-to-level trades. But because of my low frequency of trades, it always impaired my chances of success as I just wouldn’t get enough trades in the given time.

So as soon as the challenge clock began ticking, I had to take every setup that came my way. Time was now the biggest limiting factor. I needed to maximise the available trade opportunities to be able to reach the profit target within 30 days. If I kept waiting around for a daily or weekly bias candle, or a high R trade, I’d likely run out of time before reaching the profit target. So I took extra care in my market review each day to make sure I didn’t miss anything and took every trade that met my criteria.

4. Take your time in stage 2 and aim for only high R trades

Steps 1 through 3 worked well for me. I completed the first (and hardest) part of the challenge, and made it to the “verification stage”. Now I just had to reach an 8% profit target, and I had 60 days to do this.

I’d still follow steps 1 and 2, using 2.4% risk per trade and only starting the challenge on a high R trade. But I’d no longer be following step 3, as time was now less of a limiting factor. What was more important was making sure that if I hit a period of drawdown it didn’t ruin my chances.

What mattered now was the quality of the trades I included. They needed to be either (a) high reward-to-risk ratio, or (b) reasonable reward-to-risk ratio but high probability. It involved a lot of patience, but enabled me to win my second account even during a period of heavy drawdown on my personal account.

5. Be careful with the daily loss limit

One thing I hate to hear about is when people breach the maximum daily loss limit without being aware of it. This is more common in prop firms that use end-of-day equity as well as end-of-day balance. Make sure you know which one your prop firm challenge uses.

If, like me, you’re going in with a high amount of risk per trade, and tending to take high reward-to-risk ratio trades, it’s easy to breach this if you’re not careful.

6. Trade with the odds on your side

Traders on X (formerly Twitter) will often tell you this or that setup is “high probability”, but if asked, wouldn’t be able to give you any actual statistics. What they really mean is “This feels like it will work”, which is very different from a setup that has some basis in statistics.

If you’re just starting out, or you’ve never kept objective data on your trades, you simply won’t know if something is high or low probability. So when faced with two similar trades, you may not know which one to take. Having access to certain statistics can help you make these decisions.

Using Bell’s Edge’s OddsRadar can help you determine if a setup has a higher probability or not. It uses algorithmically collected data over the last 10+ years of price action across 42 forex and futures markets and informs you of the probability of price action patterns in the market each day. Click here for a free 7-day trial.

7. Don’t take it too seriously

Probably the hardest step of all. I get it. Winning a funded account is a massive game changer in terms of income potential. But you will always get another chance.

I decided at the start that I would keep taking the challenges until I passed. My stats told me the probability of success was high, so the challenge fees were a worthy investment. Once passed, there was a decent chance of a big return in the future.

Sometimes you‘ll get lucky and pass. Sometimes you‘ll be unlucky and fail. But as long as you have a profitable strategy, and don’t let the challenge conditions affect your trading process, you’ll get there in the end.

Some have criticised the business models of online prop firms. In the BBC documentary “Insta Traders”, they looked at FTMO and criticised them because they make a lot of their income from the fees of failed challenges. I found this criticism absurd, given that passing the challenge means a full refund of this fee. There is also total transparency that if you lose the challenge you lose the fee. If someone decides to take the challenge they do so knowing that if they don’t pass it, they’ll lose the fee.

Many newer traders get excited about the prospect of a bigger account and may lose a lot of money taking challenges before they’re ready. I was lucky that I only found out about them after being profitable for a year, so I didn’t fall into this trap. But even then I had to run countless simulations to convince myself it wouldn’t be a waste of money. Make sure you have a genuine chance of passing before you pay for a challenge.

The potential upside these firms can offer is huge, and there’s no better time than right now to be a profitable trader. You don’t need any formal qualifications, you don’t need to pass any exams, you don’t need to interview, you don’t even need to leave the house. You just have to show that you can trade. So hone that skill, optimise your strategy, and pass that challenge. Your future awaits…