The Neuroscience of Drawdown: How to Make Your Brain Invincible to Losses

Understanding dopamine’s role in trading performance and 4 neuroscience-backed strategies to manage your brain’s response to losses

Trading can be incredibly rewarding when things are going well. But the flip side of that is that when they aren’t, it can be utter hell.

The impact of being on a steady downtrend in equity on one’s mental state is rarely talked about. We’re quick to hear about all the upsides – people love to talk about how well they’re doing. But few want to talk about how badly they’re doing.

The reality is that traders will be in drawdown the majority of the time. While profitable traders will make frequent new peaks in equity, there will always be losers, and these losers create drawdowns.

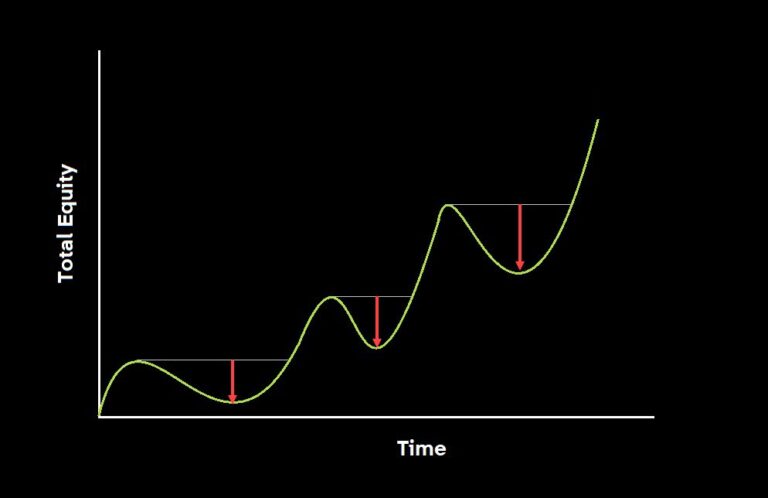

The image below shows how drawdowns appear on one’s equity curve, with the red arrows showing the depth of the drawdown.

The depth and duration of these drawdowns depend on the strategy. A swing trader with a 40% strike rate will have longer and deeper drawdowns than a scalper with a 90% strike rate.

Drawdown can affect your mental state in a way that makes it hard to execute your strategy. The longer and deeper the drawdown, the harder it becomes. This only exacerbates the drawdown, and makes it harder to get out of it. This downward spiral has led many traders to “blow up” their accounts entirely.

But before you get too anxious or depressed, there are some simple things you can do to avoid falling into this trap. If drawdown is an inevitable part of being a trader, then what we really need is to find a better way to cope with it. Not only will this help us enjoy the process of trading again, but it will allow us to continue executing our strategy.

Let’s start by understanding what’s going on in the brain when you’re in drawdown.

It’s all about dopamine

The reward we get when trading comes from our reward system. The reward system began as a primitive, survival-seeking circuit, and evolved into a sophisticated, motivation-management system. It motivates us to do the things that feel most rewarding.

The currency of the reward system is dopamine. Dopamine’s role is to reinforce rewarding behaviours through association: it will take a neutral stimulus, like a price chart, and associate it with a reward, like profit from a trade, and soon every time you see a price chart you are inherently motivated to look for setups.

Dopamine is the “switchboard” that helps you filter incoming stimuli and decide what is motivationally relevant. It helps you distinguish between price action that is just noise, and price action that has the potential for a decent profit. It draws your attention to the news events that may impact your trade. And it ensures you don’t miss the next jaw-dropping setup on the chart. The brain gets a spritz of dopamine with these initial cues, then another upon arrival of the reward.

Each time the reward system is activated by dopamine, the relevance of the cue (the setup on the chart) and the reward (the profit from the trade) increase. Dopamine tells your brain to pay more attention to these cues, by helping you remember anything related to the reward. It’s why the sight of your favourite setup captures your attention more than the other bars on the chart. Stimuli linked to a reward grab your attention – thanks to dopamine.

This tendency for setups to jump out at you is called salience, and it’s dopamine’s role to make the profit-generating setups more salient. To make things more salient, dopamine hits your reward pathway with the mere sight of a potential setup, and with each successful trade.

So when things are going well, dopamine aids us in our trading by:

- Helping us to remember the setups that worked.

- Making these setups more salient and easier to spot next time.

- Increasing our motivation to keep looking for them.

But what happens when we take losing trades?

The anti-reward system

The reward system lights up whenever your brain wants to reinforce a behaviour, like the actions you took to get a winning trade. But what happens when your actions lead to losses, not profits?

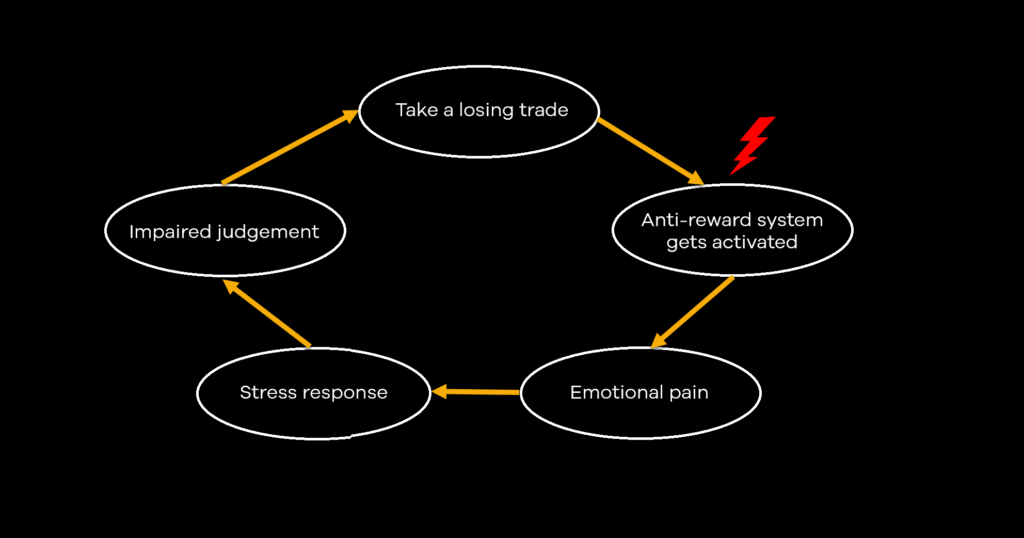

The habenula, also known as the “disappointment nucleus”, powers the anti-reward system of your brain. While the reward system promotes behaviours, the anti-reward system does the opposite. By sending signals that create a dip in dopamine levels, it shuts down the reward system and creates a feeling of disappointment. This discourages you from the same behaviour in future.

This is why when you take a losing trade, it feels unpleasant. That unpleasant feeling is what helped your ancestors avoid behaviours that could have wiped them out of the gene pool. But when it comes to trading, this response can be a double-edged sword.

Sure, it might help you avoid bad behaviours like impulsive entries, or taking low-quality setups. A dose of disappointment is probably what you need to stop you from repeating these mistakes. But if taking losers is part and parcel of trading, and even good setups can lose, then it may have unintended consequences.

Your habenula doesn’t understand that you can make all the right decisions and still get a losing trade. Instead, it tells you with every loser that you screwed up and discourages the behaviours that led to the loss. This is how drawdown leads to issues with execution – your brain is trying to save you from repeating the same mistakes.

But it gets worse. Taking a string of losers leads your brain to tell you again and again that you screwed up and punishes you with more emotional pain. This is stress-inducing, and if it persists can lead to chronic release of the stress hormone cortisol.

Stress can be a good thing if it’s short-lived and serves its purpose – to give you an energy boost and help you solve whatever problems you’re facing. But when it lingers around and becomes chronic, as it can in prolonged drawdown, it can start to have a whole host of negative effects on your body and mind.

The downward spiral

Let’s say you’ve been in a 20% drawdown for the last two months. The endless hits to your anti-reward system start to take their toll. It begins to impact the way you feel each day. You no longer feel the zest for life that you felt during your winning periods. You’re more irritable, and the smallest things can lead you to fly off the handle. You’re not as motivated to trade any more, with every setup feeling like yet another trap. You dread the idea of having to take another trade. You question if your career as a trader is over, as you watch your equity slowly disappear before your own eyes.

Your dopamine-deficient, chronically stressed brain begins making bad judgements. What was once the effect of your drawdown, now becomes the cause of it. You begin taking “revenge trades” after each loser, desperately seeking a win to feel good again but instead taking another loser. You impulsively take low-quality setups because you don’t want to have to wait for a great setup, you need to feel better now. Sometimes you try to run trades to an unrealistic profit target, seeking bigger profits to make up for recent losses. Other times you bank profits too early as you fear the agony of another loss. Every decision you make is based in fear and desperation, and leads to a worse outcome.

Eventually, you stop trading altogether. The pain of taking more losers is just too agonising to face.

If any of this sounds familiar, you’re not alone. While it can seem like your world is ending, there are simple strategies and techniques to help you avoid ending up here. You may not be able to avoid the drawdowns, but it’s possible to live through them while maintaining your ability to trade your way out of them.

Here are six tips that have helped me get through my worst periods of drawdown.

1. Get reward elsewhere

The effect of drawdown is always worse when trading is your primary source of reward. If trading is the only thing that gives you reward in life, when it stops delivering it becomes difficult to enjoy life until you’re winning again.

Having other hobbies and passions can help limit this effect. If you’re able to get your reward from other pursuits amid a heavy drawdown, it will have less of an impact on you and your trading. You’ll still get the dip in dopamine with each loser you take, but they won’t compound in the same way as you’ll have plenty of healthy dopamine spikes while you’re doing those other things you love to do.

So whether it’s going skating, making sourdough, or going camping, make sure you keep these other pursuits going through good times and bad.

2. Improve your baseline level of dopamine

The way you feel on any given day is strongly influenced by your baseline level of dopamine. When the level is high, you tend to feel highly motivated with a sense of well-being. When the level is low, you may feel lethargic and like everything is a chore.

While there aren’t any good studies to say for sure, losing periods likely impact your baseline of dopamine negatively. Some studies have linked habenula activation with a lowering of dopamine levels in the part of the brain where the reward system is found. As this level of dopamine gets lower you may become more irritable, frustrated, and lethargic. This in turn may lead to bad decisions in your trading.

But there are things you can do to elevate this level of dopamine. Again having other hobbies is key here. Hobbies help improve dopamine levels through healthy activation of the reward system. It’s thought that the more effort involved in gaining this reward, the better the positive effect on dopamine. This is because your brain starts to associate the very feeling of effort with reward. So going fishing or kitesurfing is probably better than playing video games.

Physical exercise has powerful effects on dopamine levels, as well as slowing brain ageing. Keeping physically active can not only be rewarding in itself, but it can also help you feel more reward from other pursuits by elevating your baseline level of dopamine.

3. Avoid overstimulating your reward system

To maintain healthy dopamine levels, you also have to be careful not to overstimulate your reward system. Doing so can desensitise you to healthy rewards like exercise and hobbies, and lead you to search for increasingly potent rewards. This has spillover effects on your trading, with a tendency to become more impulsive and pleasure-seeking. This interferes with your ability to make careful judgements on the trades you take.

Rewards lead to a spike in dopamine levels in the reward system. Whenever you get a strong reward that significantly spikes dopamine, there’s a dip in your baseline dopamine level shortly after. The bigger the dopamine spike, the more prominent the dip. This dip is why you might feel a bit listless the day after a huge achievement or celebration. It’s this tendency for dopamine to dip after a big spike that leads many toward addictive and compulsive behaviours, as repeating the behaviour makes them feel good again. But only temporarily, and soon they experience another dip.

Things like alcohol, nicotine, recreational drugs, pornography, gambling, and eating sugary junk food all spike dopamine in an extreme way. And with that spike comes a dip afterward, which over time can lower your baseline of dopamine. Limiting these activities as much as possible can limit the negative impact of drawdown by keeping your baseline dopamine at a healthy level.

If you want to learn more about dopamine check out this great podcast by Andrew Huberman for more about how to keep your dopamine system in a healthy balance. For a more in-depth look, read “Dopamine Nation” by Anna Lembke.

4. Manage your stress

Drawdown can feel like the end of the world if you let it. This is what the anti-reward system tells you. But you can train yourself to accept this feeling as just that – a feeling. Even if your account is on the verge of total wipeout, it helps to step back and see the bigger picture. It doesn’t mean you’ll never be successful as a trader. It doesn’t mean you’ve lost your edge forever. And it doesn’t mean you have to feel terrible.

While physical exercise and hobbies can help manage stress, as well as keeping the reward system healthy, when it comes to managing stress I find meditation to be the most powerful tool.

Meditation helps you take a mental step back and gain perspective. It helps you step outside of the story you tell yourself about your life (like being a losing trader), and find peace in the present moment. It’s amazing how much just focusing on your breath for ten minutes a day can ground you in reality. If you’re new to it, I’d recommend using Sam Harris’ Waking Up app. I’ve been using it for years, and find it especially helpful in harder times.

Drawdown is most stressful when you begin to question if you’ve lost your edge as a trader. It’s that voice in the back of your mind saying “This could be it for you” that really messes with your process. But what if you knew for certain that in a few weeks time, you’d be at a new peak in equity? Would the drawdown you’re experiencing bother you much at all?

The more confidence you have in your strategy and your ability to trade, the more faith you’ll have that any drawdown, no matter how deep, is just temporary. Trying to maintain this mindset will not only help you make better decisions in your trading, but you’ll be free to enjoy the process of trading again. Because ultimately it’s more about enjoying the journey, through the ups and downs, than reaching the destination.